Page 7 - The Shores of Jupiter - August '20

P. 7

The Shores, Page 7

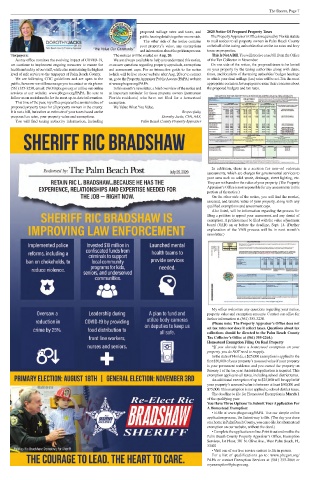

proposed millage rates and taxes, and 2020 Notice Of Proposed Property Taxes

public hearing details together on one side. The Property Appraiser’s Office is required by Florida statute

The other side of the notice contains to mail notices to all property owners in Palm Beach County

your property’s value, any exemptions on behalf of the taxing authorities that set the tax rates and levy

and information about the petition process. taxes on properties.

Taxpayers: The notices will be mailed on Aug. 20. This Is Not A Bill. You will receive a tax bill from the Office

As my office monitors the evolving impact of COVID-19, We are always available to help you understand this notice, of the Tax Collector in November.

we continue to implement ongoing measures to ensure the or answer questions regarding property appraisals, exemptions On one side of the notice, the proposed taxes to be levied

health and safety of our staff, while also maintaining the highest and assessment caps. For an interactive guide to the notice on your property by the taxing authorities along with dates,

level of safe service to the taxpayers of Palm Beach County. (which will be live on our website after Aug. 20) or to contact times, and locations of the taxing authorities’ budget hearings

We are following CDC guidelines and are open to the us, go to the Property Appraiser Public Access (PAPA) website in which your final millage (tax) rates will be set. It is the most

public, however we still encourage you to contact us via phone: at www.pbcgov.org/PAPA. appropriate occasion for taxpayers to raise their concerns about

(561) 355-3230, email: PAO@pbcgov.org or utilize our online In this month’s newsletter, a brief overview of the notice and the proposed budgets and tax rates.

services at our website: www.pbcgov.org/PAPA. Be sure to an important reminder for those property owners (permanent

follow us on social media for the most up-to-date information. Florida residents) who have not filed for a homestead

This time of the year, my office prepares the annual notice of exemption.

proposed property taxes for all property owners in the county. We Value What You Value.

It is not a bill, but rather an estimate of your taxes based on the Respectfully,

proposed tax rates, your property value and exemptions. Dorothy Jacks, CFA, AAS,

You will find taxing authority information, including Palm Beach County Property Appraiser

In addition, there is a section for non–ad valorem

assessments, which are charges for governmental services to

your area such as solid waste, drainage, street lighting, etc.

They are not based on the value of your property. (The Property

Appraiser’s Office is not responsible for any assessments in this

portion of the notice.)

On the other side of the notice, you will find the market,

assessed, and taxable value of your property, along with any

qualified exemptions and assessment caps.

Also listed, will be information regarding the process for

filing a petition to appeal your assessment and any denial of

exemption. A petition must be filed with the value adjustment

board (VAB) on or before the deadline, Sept. 14. (Further

explanation of the VAB process will be in next month’s

newsletter.)

My office welcomes any questions regarding your notice,

property value and exemption amounts. Contact our office for

further information at (561) 355-3230.

(Please note: The Property Appraiser’s Office does not

set tax rates nor does it collect taxes. Questions about tax

collections should be directed to the Palm Beach County

Tax Collector’s Office at (561) 355-2264.)

Homestead Exemption Filing On Real Property

*If you already have a homestead exemption on your

property, you do NOT need to reapply.

In the state of Florida, a $25,000 exemption is applied to the

first $50,000 of your property’s assessed value if your property

is your permanent residence and you owned the property on

January 1 of the tax year. An initial application is required. This

exemption applies to all taxes, including school district taxes.

An additional exemption of up to $25,000 will be applied if

your property’s assessed value is between at least $50,000 and

$75,000. This exemption is not applied to school district taxes.

The deadline to file for Homestead Exemption is March 1

of the qualifying year.

You Have Three Options To Submit Your Application For

A Homestead Exemption:

• E-file at www.pbcgov.org/PAPA. Use our simple online

application process, the fastest way to file. (The day you close

on a home in Palm Beach County, you can e-file for a homestead

exemption on our website, without the deed.)

• Complete the application online. Print it out and mail to the

Palm Beach County Property Appraiser’s Office, Exemption

Services, 1st Floor, 301 N. Olive Ave., West Palm Beach, FL

33401

• Visit one of our five service centers to file in person.

For a list of qualifications go to: www.pbcgov.org/

PAPA or contact Exemption Services at (561) 355-2866 or

myexemption@pbcgov.org.