Page 7 - Martin Downs Bulletin - March '20

P. 7

Martin Downs, Page 7

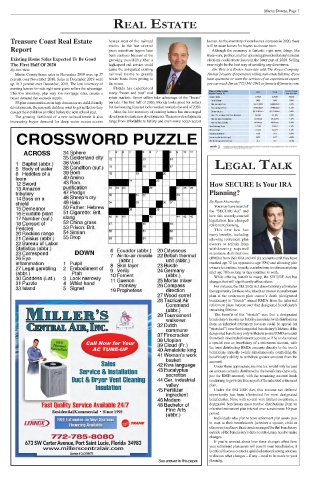

real estate

Treasure Coast Real Estate homes west of the railroad homes. As the inventory of new homes increases in 2020, there

Report tracks. In the last several will be more homes for buyers to choose from.

years waterfront buyers have

Although the economy is fantastic right now, things like

been cautious because of the trade wars, politics, and the upcoming presidential and national

Existing Home Sales Expected To Be Good growing possibility that a elections could create issues in the latter part of 2020. Selling

The First Half Of 2020 high-speed rail service could now might be the best way of avoiding any downturns.

By Jim Weix cause the antiquated existing Jim Weix is a Broker Associate with The Keyes Company.

Martin County home sales in November 2019 were up 27 railroad trestle to greatly Jim has 24 years of experience selling real estate full time. If you

percent over November 2018. Sales in December 2019 were hinder boats from getting to have questions or want the services of an experienced expert,

up 18.3 percent over December, 2018. The low inventory of the ocean. you can reach Jim at (772) 341-2941 or jimweix@jimweix.com.

existing homes for sale right now gives sellers the advantage. Florida has experienced

This low inventory, plus very low mortgage rates, creates a many “boom and bust” real

buyer demand that exceeds supply. estate markets. Smart sellers take advantage of the “boom”

55-plus communities are in high demand as are child-friendly periods. The first half of 2020, Florida looks good for sellers

developments. Buyers with children want to get settled so they but the housing forecast looks weaker towards the end of 2020.

can get their children enrolled before the new school year. Also, the low inventory of existing homes has encouraged

The growing likelihood of a new railroad trestle is also developers to create new developments. These new developments

increasing buyer demand for deep water ocean access range from affordable to luxury and even some ocean access

leGal talk

How SECURE Is Your IRA

Planning?

By Ryan Abernethy

You may have heard of

the “SECURE Act” and

how this recently-enacted

legislation has changed

retirement planning.

This new law has

many benefits, including

allowing retirement plan

owners to refrain from

withdrawing required

minimum distributions

(RMDs) from their IRA and 401(k) accounts until they have

reached age 72 (as opposed to age 70½) and allowing plan

owners to continue to make contributions to retirement plans

after age 70½ so long as they continue to work.

While offering benefit to many, the SECURE Act has

changes that will significantly affect others.

For instance, the SECURE Act almost entirely eliminates

the opportunity for those who inherit an interest in a retirement

plan at the retirement plan owner’s death (designated

beneficiary) to “stretch” annual RMDs from the inherited

retirement plans interest over that designated beneficiary’s

remaining lifetime.

The benefit of the “stretch” was that a designated

beneficiary’s income tax liability associated with distributions

from an inherited retirement account could be spread (or

“stretched”) over that designated beneficiary’s lifetime if the

designated beneficiary only withdrew annual RMD amounts

from their inherited retirement account, or if he or she named

Call Now for Your a special trust as beneficiary of a retirement account, with

AC TUNE-UP the trust distributing RMDs amounts directly to the trust’s

beneficiary annually (while simultaneously controlling the

beneficiary’s ability to withdraw greater amounts from the

account).

Under these approaches, income tax would only be paid

on amounts actually distributed to the beneficiary (typically,

just the RMD amount), with the remaining account funds

continuing to grow tax-free as part of the inherited retirement

plan.

Under the SECURE Act, this income tax deferral

opportunity has been eliminated for most designated

beneficiaries. Now, with several very limited exceptions, a

designated beneficiary must receive distributions from an

inherited retirement plan interest over a maximum 10-year

period.

Individuals who plan to have retirement plan assets pass

in trust to their beneficiaries (whether a spouse, child or

otherwise) and have those assets managed for that beneficiary

outside of the beneficiary’s direct control, may need to make

changes.

673 SW Carter Avenue, Port Saint Lucie, Florida 34983 If you’re worried about how these changes affect how

www.millerscentralair.com your retirement plan assets will pass to your beneficiaries, it

is critical that you contact a qualified estate planning attorney

to discuss what changes – if any – need to be made to your

See answer in this paper. planning.